Fuel innovation in electronic product development, manufacturing and system integration. Companies in the electronics sector are constantly developing new devices, sensors, circuit boards, embedded firmware, packaging processes and manufacturing lines—and many of these activities may qualify for the federal R&D Tax Credit under IRC §41 (as well as relevant state‑level credits).

Examples of qualifying activities in electronics manufacturing

- Sensor & Device Development Designing and prototyping new MEMS sensors, IoT modules, wearable electronics, printed electronics; performing lab/field testing for reliability, lifespan, power consumption.

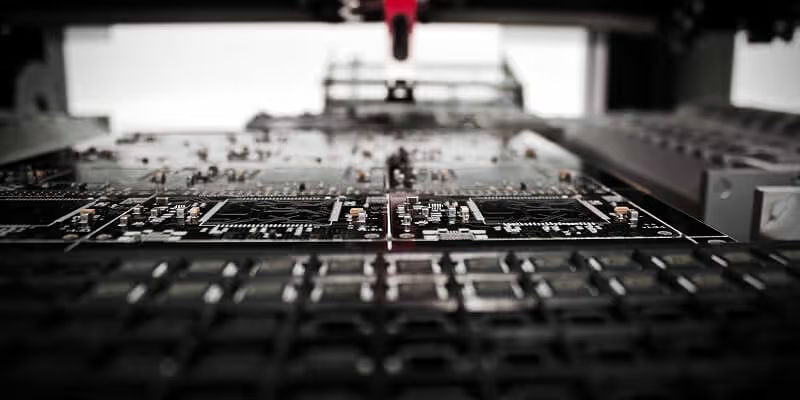

- Circuit Board & Packaging Innovation Developing high‑density PCBs, novel substrates (flex/rigid‑flex), advanced packaging (ball grid, micro‑vias), thermal management or EMI shielding innovations.

- Manufacturing Line & Process Improvement Upgrading pick‑and‑place machines to handle microcomponents, automating inspection (optical/vision), halogen‑free solder process trials, shrink‑pitch assembly runs, yield‑ improvement experiments.

- Firmware, Embedded Systems & Device Integration Creating new firmware for low‑power operation, integrating sensors and wireless modules, field trials of prototypes, debugging reliability/firmware/hardware interactions.

- Sustainability & Materials Trials Testing lead‑free solder alloys, new substrate materials, eco‑friendly packaging for electronics, reducing defect/waste via new process controls or materials substitutions.

What qualifies as R&D in Electronics?

To qualify, your electronics‑industry activities must:

- Pursue a permitted purpose — such as a new or improved electronic device or module, a novel sensor or circuit board, an upgraded manufacturing process or test system, or improved product reliability, miniaturisation or power efficiency.

- Address technical uncertainty — for example: “Will the new sensor maintain accuracy under elevated temperature and vibration?”, “Can we redesign the PCB layout to reduce electromagnetic interference below the customer spec?”, “Will the new manufacturing line reliably handle smaller pitch components at higher throughput without increase in defect rate?”

- Follow a process of experimentation — lab prototypes, PCB layout iterations, firmware/hardware integration tests, manufacturing line trials, simulation modelling of electrical/rf/thermal performance.

- Be technological in nature, grounded in electrical engineering, electronics materials science, microelectronics manufacturing, firmware/embedded systems, test automation or manufacturing engineering.

Qualified Research Expenses (QREs)

For electronics manufacturing and development the IRS recognises the following categories:

Roles commonly involved in qualifying activities

- Electronics design engineers developing new device/product architectures

- Manufacturing/process engineers working on assembly line innovations, yield improvement

- Firmware/embedded system engineers integrating sensors, wireless modules, power systems

- Test & validation engineers conducting reliability, field, thermal, vibration tests

- Materials scientists evaluating new substrates, packaging, solder alloys, eco‑friendly materials

- External partners or labs performing third‑party evaluations, trial runs, advanced packaging tests

What does not qualify

- Routine production of devices or modules without experimentation or improvement (e.g., standard assembly of proven products)

- Applying known circuit board layouts or firmware code repeatedly without technical uncertainty or iteration

- Sales, marketing, administrative or customer‑service tasks unrelated to research or experimentation

- Land acquisition, building expansion, or standard machinery purchases for scale‑up not tied to a research/test program

Compliance and Documentation

Following the One Big Beautiful Bill Act (OBBBA) signed July 4, 2025, §174 now allows immediate expensing of domestic research expenses for tax years beginning on or after January 1, 2025. Taxpayers may also elect optional amortization under new §174A. Foreign research expenses must still be amortized over 15 years. This is separate from the §41 credit but impacts overall tax planning.

Documentation remains essential — electronics companies should maintain records including:

- Project briefs (e.g., “Develop next‑gen sensor with <10 µW standby power, test for 10,000 hrs at 85 °C/85%RH”)

- Prototype test logs, environmental/field trial data, failure records, iterations

- Employee time tracking showing R&D involvement, payroll allocation by project

- Version histories: board/layout iterations, firmware releases, alternate materials

- Manufacturing trial data: yield before/after, defect rates, scrap logs, throughput improvements Strong documentation supports the four‑part test under §41 (permitted purpose, technical uncertainty, process of experimentation, technological in nature) and strengthens audit readiness.

Frequently Asked Questions

Yes — if your company is engaged in the development of new or improved electronic devices, modules, circuit boards, embedded systems or manufacturing/assembly processes that involve experimentation rather than routine manufacturing.

Wages for engineers/testers/research staff, prototype/test supplies, simulation or design software/analytics platforms, third‑party contractor services tied to qualified research.

Examples include: prototyping a new sensor or wearable electronics device, redesigning a PCB for higher density, testing new packaging/assembly process, automating assembly to handle microcomponents, trialling new materials for reliability or sustainability.

Routine production or scaling of established processes without experimentation, standard packaging line change‑overs without technical uncertainty, or non‑technical tasks such as marketing, sales or general administration.

Credit values vary widely based on scope, eligibility, and documentation. Industry sources suggest refunds up to about 22% of qualified research expenses when properly documented, depending on location.

Maintain detailed project hypotheses (e.g., “Can this new PCB layout reduce EMI by 30% at 2.4GHz while maintaining manufacturability?”), pilot and test logs, timesheets for personnel on R&D, version history of boards/firmware/prototypes, manufacturing trial data comparing yield/scrap before and after.

Next Steps

Use our calculator to estimate your potential federal and state benefits

Schedule a consultation to structure your row crop research activities

If you are innovating in agriculture, you may already be doing R&D. Let's make sure you are rewarded for it.

Contact Strike Tax Advisory

Ready to maximize your R&D tax credits? Get in touch with our team of experts.

Manufacturing

With just a little info, our Strike Experts can help you start your R&D tax credit journey.

Got questions?

We’ll walk you through our process and take the time to understand yours to make sure you get the most back.

Schedule a MeetingRelated Sub-Industries

Does your state qualify for the State R&D Tax Credit?

Benefits for the R&D Tax Credit vary from state to state. Get an accurate estimate of your potential state tax credit!