Maximize innovation in product engineering. Product engineering firms in the U.S. design and develop new or improved physical products, systems, or components — from concept through prototyping, testing and manufacturing integration. Many of these efforts meet the criteria for the federal R&D Tax Credit under IRC §41, and state‑level incentives may also apply.

Examples of qualifying activities in product engineering

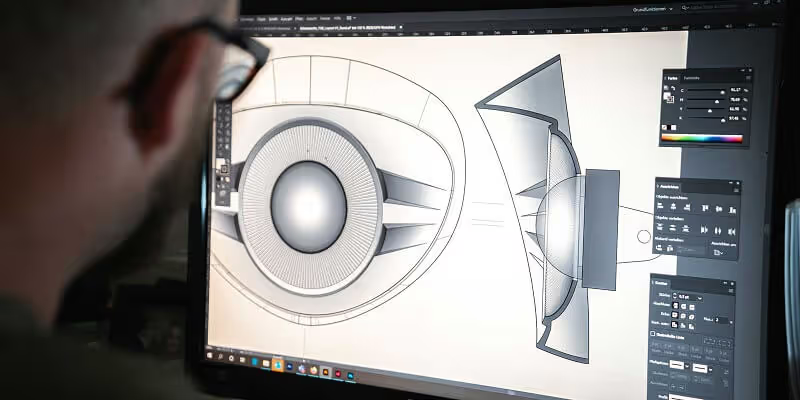

- Prototype Development & Testing Designing new product prototypes, testing durability, materials substitution, manufacturing methods, performance verification, etc.

- Manufacturability & Process Engineering Developing new manufacturing workflows, automation integration, assembly‑line redesign, additive manufacturing adoption, new tooling or fixture systems.

- Materials Innovation & Embedded Systems Testing new materials, composites, electronics integration, sensor/actuator networks within the product, or embedded control systems.

- Product Performance/Functionality Upgrades Refining product architecture to reduce weight, improve efficiency, add features, improve durability or reduce cost via new technology.

- Sustainability / Circular‑Economy Products Designing for recyclability, remanufacturing, reducing embodied carbon, modular/upgradable products, or material‑reuse pathways.

What qualifies as R&D in product engineering?

To qualify, activities must:

- Pursue a permitted purpose – a new or improved product, component, system or manufacturing process

- Address technical uncertainty about how to design, build or manufacture that product (e.g., performance, reliability, manufacturability, cost)

- Follow a process of experimentation — via prototype iterations, modelling/simulation, pilot production, testing or manufacturing validation

- Be technological in nature, grounded in engineering (mechanical, electrical, materials), computer science, manufacturing systems or systems integration

Qualified Research Expenses (QREs)

Roles commonly involved

- Product design engineers and systems engineers pushing new functionality

- Test engineers and prototype technicians building verification systems

- Simulation/modeling specialists (FEA, CFD, durability, electronics integration)

- Manufacturing/process engineers working on new assembly/manufacturing methods

- Research partners: materials labs, testing labs, automation/tooling integrators

What does not qualify

- Standard product design using proven components and known methods without experimentation

- Production of products without development of new or improved function/process

- Routine maintenance, servicing, or aftermarket tasks without innovation

- Sales, marketing, administrative, or aesthetic‑only design tasks without technical uncertainty resolution

Compliance and Documentation

Following the One Big Beautiful Bill Act (OBBBA) signed July 4, 2025, §174 now allows immediate expensing of domestic research expenses for tax years beginning on or after January 1, 2025. Taxpayers may also elect optional amortization under new §174A. Foreign research expenses must still be amortized over 15 years. This is separate from the §41 credit but impacts overall tax planning.

Product engineering firms should:

- Maintain narratives describing technical uncertainty being resolved (e.g., “We developed a lighter composite housing that withstands X stress reduction while being manufacturable”)

- Archive simulation/modeling logs, prototype testing data, manufacturing trial logs, iteration records

- Track time for employees engaged in research/innovation vs routine design tasks

- Ensure contracts/agreements show the firm retains rights and bears research risk Comprehensive documentation supports the IRS four‑part test and strengthens audit defense.

Frequently Asked Questions

Yes — when they engage in new product design, improved manufacturing methods, materials innovation, embedded systems integration or sustainability‑driven redesign, they may qualify.

Wages of engineers/testers involved in innovation, materials/hardware for prototypes, simulation/software platforms, contract research with testing/automation vendors.

Examples: new product with improved performance, prototype development, new manufacturing line/process, materials substitution, embedded electronics integration, circular‑economy product design.

Production without innovation, standard product upgrades using off‑the‑shelf parts, maintenance/upgrades without design or process innovation, marketing or administrative work.

Use narratives of technical problems and experiments, retain simulation/model logs, prototype/test logs, manufacturing trial data, track employee time on research tasks, maintain iteration versioning.

Varies by scope and investment. Firms with structured innovation programmes may capture significant credits; even smaller R&D efforts can meaningfully offset tax liability.

Next Steps

Use our calculator to estimate your potential federal and state benefits

Schedule a consultation to structure your row crop research activities

If you are innovating in agriculture, you may already be doing R&D. Let's make sure you are rewarded for it.

Contact Strike Tax Advisory

Ready to maximize your R&D tax credits? Get in touch with our team of experts.

Architecture

With just a little info, our Strike Experts can help you start your R&D tax credit journey.

Got questions?

We’ll walk you through our process and take the time to understand yours to make sure you get the most back.

Schedule a MeetingRelated Sub-Industries

Does your state qualify for the State R&D Tax Credit?

Benefits for the R&D Tax Credit vary from state to state. Get an accurate estimate of your potential state tax credit!